Seeing Future Development Areas

Real estate investors who take a long-term approach sometimes buy raw land or rundown buildings in an area that they expect to be developed or re-developed in the future making them a handsome profit.

Real estate investors who take a long-term approach sometimes buy raw land or rundown buildings in an area that they expect to be developed or re-developed in the future making them a handsome profit.

How do these real estate investors know where the good places to invest are? How do they find a good deal?

There are four main ways to profit from anticipating future development in an area, which are:

1) Buy raw land and hold it, until the value increases or subdivide it into smaller lots to increase total value, which we talked about in another post.

2) Invest in rundown neighborhoods that have a potential for re-development through gentrification.

3) Acquire land and/or properties with the intent to build a new development.

4) Anticipate government need for the property.

Growth Trends

One way to see the emerging growth trends of any area is to check the pattern of historical growth by viewing the past aerial photographs of the area available at Historical Aerials. There are also some newer historical aerials viewable by using Google Earth.

Take Houston, for example. When one looks at the aerial photos of Houston from 1953, which are the oldest ones they have on Historical Aerials, it is plain to see there are vast vacant tracks of land in the northern part of Houston, and west of Houston near Aldine. Some of this land adjacent to Aldine was already an incorporated part of the city of Houston in the 1950s, so clearly the city founders recognized that this area would eventually be developed into a thriving part of the Houston Metro area.

By selecting the aerial photos of the same area for the following years, this shows a kind of time-lapse presentation of how the development occurred over the decades that followed. In 1981, there is significant development in the area just west of Aldine that is outside the Houston city limits, yet during this period there was still plenty of raw land available in that area.

The area starts to have more housing developments by 2004. By 2012, there is significant development in the area west of Aldine and still there is some vacant land in the area. Over the next two decades from now, it is likely that this area we see continued development.

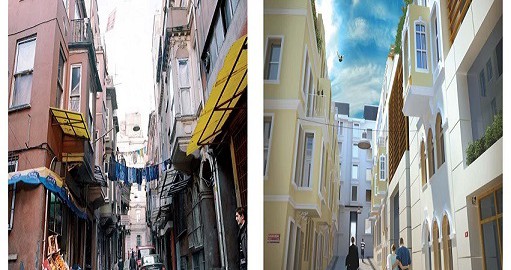

Gentrification of a Neighborhood

Ethnically-concentrated neighborhoods on the borders of more mixed neighborhoods are candidates for gentrification. Gentrification happens when lower rents, in a somewhat rundown neighborhood, attract bohemian types, such as artists and musicians. The next things that happen to cause gentrification are re-development construction projects.

Many oppose gentrification because it displaces poor families and neighborhood small businesses. Others favor gentrification because it transforms a rundown neighborhood into a new neighborhood with multi-use buildings, shops, and restaurants.

To find areas that have gentrification potential, look around the edges of the borders of the “nice” neighborhoods. One may find a physical barrier, like train tracks or a river separating the two areas or an invisible border such as a big street that causes the separation. If people and vehicles flow easily from one neighborhood to another, gentrification is possible.

Summary

Real estate investors who are developers and those that are good at seeing future trends for city expansion, gentrification, and government needs, can profit substantially by buying properties, at low prices, in advance of the trends becoming obvious to everyone else.